How Zumifi Modernizes Bookkeeping for Growing Businesses

How Zumifi Modernizes Bookkeeping for Growing Businesses In the evolving landscape of financial management, businesses are moving away from traditional onsite accounting toward integrated, cloud-based solutions. Zumifi provides a specialized framework for small...

Attaching Documents in QuickBooks Online

Attaching Documents in QuickBooks Online Unlock the power of seamless document management in QuickBooks Online and experience effortless record-keeping that keeps your business ahead. Say goodbye to physical clutter and welcome a streamlined, digital document...

Navigating the Capitalization Policy: Insights and Strategies

Navigating the Capitalization Policy: Insights and Strategies Understanding the nuances of capitalization policy is paramount in financial management. This policy is a guiding framework for determining whether a significant purchase should be classified as a business...

Transform Your Record Keeping with QuickBooks Mileage Tracker!

From Glovebox Chaos to Cloud Precision: The Evolution of Mileage Tracking Imagine a world where the dreaded mileage log, that crumpled notebook in your glovebox, or the frantic end-of-month scramble to reconstruct your calendar, simply ceases to exist. This...

Why You Need a Strategic Financial Partner

Is Your Bookkeeper Just a Secretary? Why You Need a Strategic Financial Partner In the early stages of a business, “bookkeeping” is often viewed as a clerical necessity—a way to keep the shoebox of receipts organized and the bank accounts reconciled. Many...

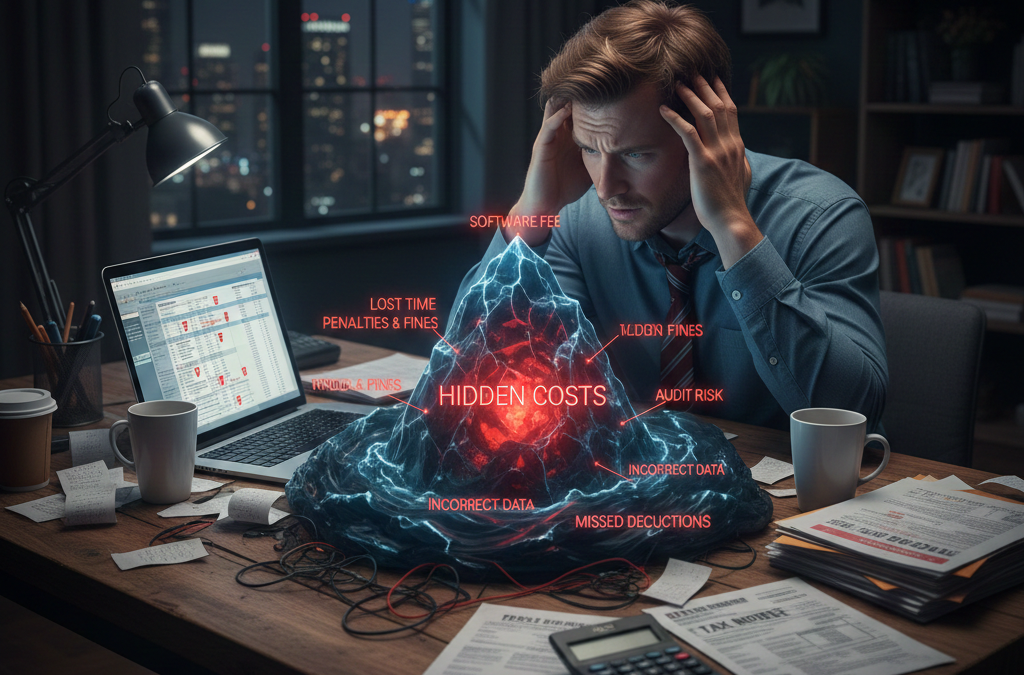

Hidden Risks of DIY Small Business Accounting

The Cost of “Doing it Yourself”: Hidden Risks of DIY Small Business Accounting For many entrepreneurs, the “DIY” spirit is a badge of honor. When you’re starting out, every dollar saved feels like a victory, and handling your own books seems...

How Real-Time Inventory Tracking Boosts Your Bottom Line

Stop Losing Money on Shelves: How Real-Time Inventory Tracking Boosts Your Bottom Line For many small businesses, inventory isn’t just stock; it’s a significant chunk of your working capital sitting on shelves. If you’re managing inventory with...

How to Transition Your Accounting to the Cloud

The Paperless Office: How to Transition Your Accounting to the Cloud This Quarter For years, the “paperless office” felt like a futuristic myth, something for tech giants in Silicon Valley, not a local small business. But the landscape has shifted. Between...