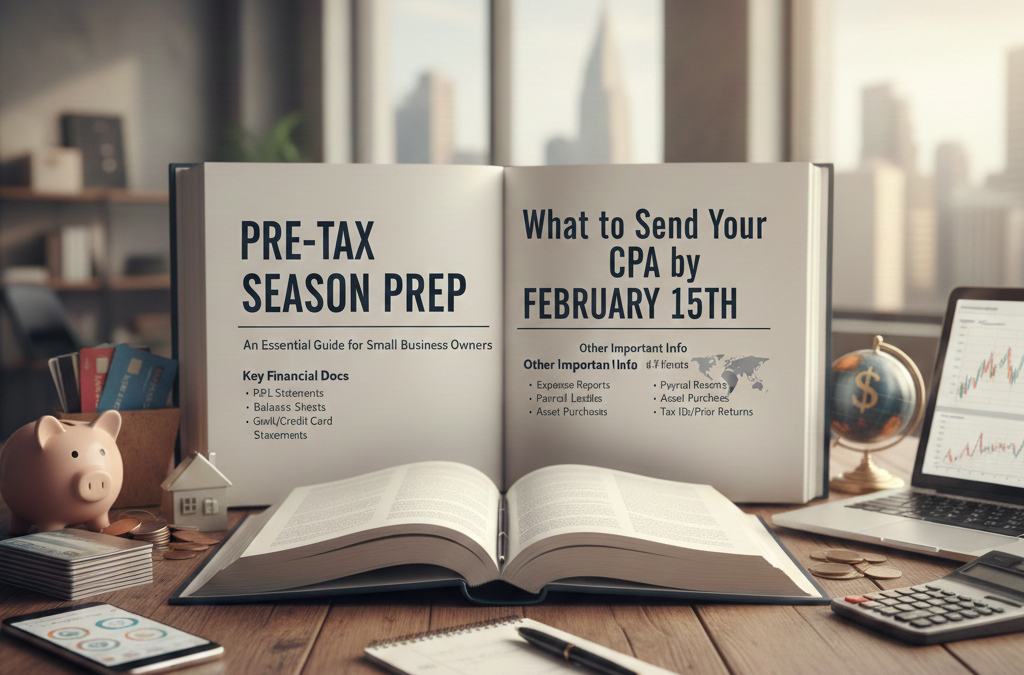

Pre-Tax Season Prep: What to Send Your CPA by February 15th

Tax season doesn’t have to be a frantic scramble. For small business owners, the secret to a stress-free filing and maximizing your deductions is getting ahead of the February 15th milestone.

While the final filing deadline is later, providing your CPA with a complete data packet by mid-February allows them to identify red flags, suggest last-minute strategies, and ensure you aren’t rushing through critical forms.

Here is your checklist of what to gather and send over to keep your accountant happy (and your tax bill lower).

1. Income Records and Information Returns

By January 31st, you should have received various tax forms from third parties. Your CPA needs these to reconcile your books with what the IRS already knows.

1099-NEC / 1099-MISC: Any forms received from clients who paid you more than $600.

1099-K: Documentation from payment processors like PayPal, Stripe, or Venmo.

1099-INT / 1099-DIV: Interest or dividends earned on business savings or investment accounts.

Gross Sales Reports: If you use a Point of Sale (POS) system like Square or Shopify, export your year-end summary.

2. Finalized Financial Statements

Before sending these, ensure your bank reconciliations are complete through December 31st.

Profit and Loss Statement (P&L): A summary of your revenue, costs, and expenses for the entire year.

Balance Sheet: A snapshot of your assets, liabilities, and equity as of year-end.

Trial Balance: Most CPAs prefer this report as it shows the “raw” balances of every account in your general ledger.

3. Expense Substantiation (The Deductions)

Don’t just send a box of receipts. Organize your expenses into categories that match your bookkeeping software. Pay special attention to:

Home Office Details: Square footage of your dedicated office space vs. the total square footage of your home, plus utility costs.

Vehicle Logs: Total miles driven for the year, specifically broken down into business, commuting, and personal miles.

Large Purchases (Assets): Invoices for equipment, vehicles, or furniture costing over $2,500. Your CPA will need these to calculate depreciation.

4. Payroll and Benefit Data

If you have employees or a team, your CPA needs to verify that your payroll taxes align with your profit reports.

Form W-3 and W-2s: The summary and individual copies of employee earnings.

Health Insurance Premiums: Documentation of premiums paid for yourself and your employees.

Retirement Contributions: Records of any contributions made to a SEP-IRA, 401(k), or SIMPLE IRA.

5. Loan and Debt Information

The principal on a loan isn’t deductible, but the interest usually is.

Form 1098: Mortgage interest if you own your business property.

Year-End Loan Statements: These show the remaining balance and the total interest paid for the year on business loans or lines of credit.

“We’ve confidently referred businesses to them, and the feedback has been unanimously positive.”

– Mike Doherty: Founder, Understanding eCommerce.

Follow us on LinkedIn – Zumifi.